Before we move on to understanding the job of an investment banker, let’s first discuss about what investment banking is, and how does the said industry sector operates. Investment banks are financial services firms that fundamentally helps high-profile clients and wealthy corporations raise funds from the public or the investors. They act as arbitrators between investors who seek lucrative investment opportunities and borrowers who seek monetary assistance to expand their business operations.

Investment banks sometimes, also serve as underwriters when it comes to IPOs (Initial Public Offerings), wherein they assist clients raise funds from the general public by issuing stocks in the financial markets. Banks need to conduct thorough market research and determine a company’s financial worth. Investment banks typically, perform various other finance operations such as offering expert guidance to clients on a particular financial product or tool. The other typical financial service an investment bank offers include helping businesses with mergers and acquisition deals.

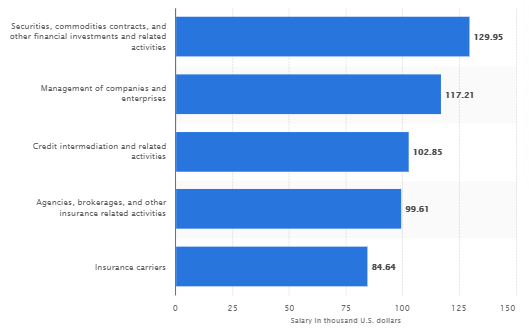

Median Earnings of a Financial Advisor in the US

Median yearly salary of financial advisors in the U.S. 2018, (by industry)

Source: Statista

As per a Statista study, the personal financial advisors in the US in sectors such as commodity contracts and securities earned a median yearly salary of USD 129,950 in 2018, which has certainly risen considerably by 2020.

Job Role & Duties of an Investment Banker

- Issuance of debts (selling bonds to wealthy investors) and sale of equity in businesses.

- Helping corporations raise funds by making them go public with sale of company shares in the stock markets in the form of IPOs (Initial Public Offerings).

- A career in investment banking demands of you to perform financial modelling to find out a company’s market valuation, before it goes public. Bankers help determine the optimum stock price for the company entering IPO to avoid under subscription.

- Offer expert assistance to businesses across industries with M&A (mergers and acquisitions) deals.

Prerequisites to Starting an Investment Banking Career

Breaking into the investment banking sector is not a tough nut to crack, but surviving in the said industry, probably is. The educational prerequisites are pretty relaxed. A bachelor’s degree in finance or a related subject discipline would suffice, however, people prefer acquiring an MBA to get a smooth entry into the lucrative industry. To acquire various types of securities licenses in the US, you need to pass tests, such as series 79, Series 63, and Series 7.

Because the competition is intensely high for investment banking jobs across the globe, coming from a top-tier university or business school certainly offers you a distinct competitive advantage. An aspiring investment bankers will never go wrong with a top-rated college or university imparting education in finance, as these are the places big banks recruit new employees from.

Skillset Needs of an Investment Banker

Investment banking certifications will more or less train you in what’s missing in terms of requisite skills. But, apart from the core financial skills that you can learn by enrolling into industry-relevant banking certifications, there are other vital skills that you need to work upon to join a reputed investment bank. These comprise:

Wisdom: A strong grasp on subjects such as mathematics, economics, and finance will help throughout your banking career. Areas of learning that will help you develop intellect and problem-solving skills would comprise – physics, engineering, economics, mathematics, finance/accounting, science, and certification programs like CIBP (Chartered Investment Banking Professional) offered by the Investment Banking Council of America.

Discipline: The outside world of investment bankers seems highly luxurious and lavish. The news portals report their sky-touching earnings, their business-class international travel itineraries, and all of the luxuries available to their disposal. But, a little gets reported about the diligence, long hours, hard work, and discipline. Bankers, starting right from entry-level analysts to the higher management personnel, operate in a high-pressure work environment in which most of us would fail to thrive in.

Professional Bonds: This skill seems like a secondary skill for a banker, but is considered among the most valued skills in the investment banking domain, especially to climb up the hierarchical structure fast. Social and soft skills, such as emotional intelligence, positive attitude, and being cordial, matters a lot in the said industry to achieve success. Eventually, investment banks earn money by charging advisory and facilitation fee to their wealthy clients, and therefore good interpersonal skills play a vital role in retaining clients.